Freeman Berkshires

Shared luxury in the sharing economy. Carbon neutral.

Shared Estates Asset Fund is a vertically integrated, carbon-neutral real estate redevelopment company and owner-operator of luxury estates for short-term rental. Industry experts say “The sharing economy, including short-term rentals, is growing fast.” Shared assets are accessible peer-to-peer (P2P) via a community based online platform, such as VRBO, HomeAway or AirBNB.

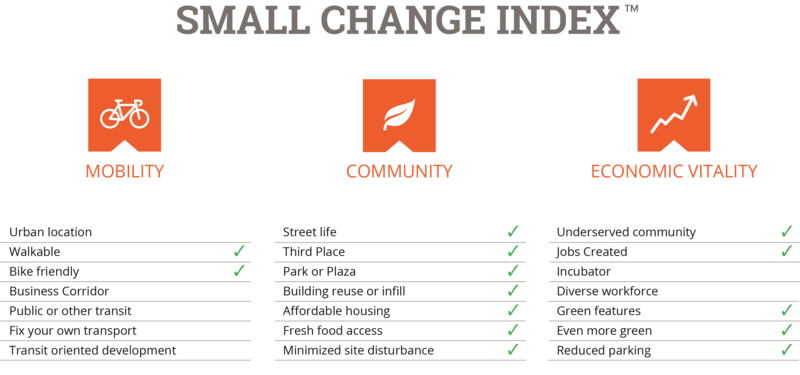

The Shared Estates Asset Fund, GP (the “Sponsor”) is focusing its acquisitions in the Berkshires of Western Massachusetts, which offer a rare, robust year-round vacation rental market. This is a region with a unique inventory of luxury estates from the 1800s and early 1900s. The area enjoyed an industrial and cultural heyday in the 1800s and early 1900s, but lost tens of thousands of jobs as major industrial companies like General Electric shuttered offices and manufacturing centers. As a result, there are many estates that are dramatically under-utilized, haven’t been renovated in decades and are even under threat of structural failure. The Sponsor plans to bring a number of these luxury and historic properties into the reach of middle class family gatherings, at a lower cost per person than standard hotel rooms. Through rehabilitation of historic properties from a vibrant past, creation of sustainable jobs and fueling the robust local tourist economy, the Fund is driving revitalization of this beautiful rural County.

This plan outlines an investment opportunity into the next property that the Sponsor plans to purchase, The Freeman Berkshires. The Playhouse (850 Summer Street, Lee, Massachusetts), the #1 vacation rental in this market, was developed, owned and operated by the management team since 2014 and recently sold at a profit.

In addition, all of the properties that the Sponsor renovates will be made carbon neutral through procurement of renewable energy credits to offset each property’s energy consumption profile. Building materials will be reclaimed materials wherever possible. No single-use amenities, such as plastic cups, will be offered. Other examples of energy conscious actions to be taken include installation of high-efficiency windows and plantings of native and edible landscaping.

Investors will be offered a preferred return on their investment and additional specified returns based on overall performance of property operations and ultimate sale. The Sponsor plans to contribute not less than 10% of equity capital, to be treated the same as Investor capital. Traditional banks are not always eager to finance projects like this, considering the location “too rural” or the business model too new. Therefore the Sponsor creatively seeks alternatives, such as investment crowdfunding or seller-financed loans.

This plan outlines the rehabilitation of a property located at 46 Bow Wow Rd, Egremont in Massachusetts (the “Property” or “Project”).The Property will be renamed The Freeman Berkshires, in tribute to Elizabeth Freeman. Elizabeth was a Stockbridge, Massachusetts woman, abused by her "master's" wife, and the first African American slave to sue and win her freedom under the Massachusetts constitution. The Sponsor plans to contribute a percentage of profits to The Elizabeth Freeman Center, a local non-profit working to end the cycle of domestic abuse and violence. A series of sculptures by local artists in a garden on the Property will pay tribute to Elizabeth as well.

The Sponsor has formed The Freeman Berkshires, LLC (the “Company”) to purchase the Property and conduct the renovations. The Sponsor has also formed Shared Estates Asset Fund 1, LLC (the “Manager”) to act as the Manager of the Company (and which the Sponsor will manage). The property is a five-bedroom, five-and-a-half bathroom, 11,400 square foot estate, on forty-one acres with tennis courts and pond. Rehabilitation work is planned to maintain the residential use and to establish the Property as a leading short term luxury rental space in the Berkshire County tourist economy. Several key focus areas will be targeted for improvement:

- The addition of two or three bedrooms (within the existing footprint in the basement floor and main floor);

- The modernization of the kitchen and all fixtures;

- Aesthetic improvements and updates to the grounds, IT and the addition of an in-ground pool and significant outdoor patios as well as repairing the existing patios and metalwork.

All construction work will be executed by a Massachusetts Licensed General Contractor, Jason Dus Construction. All work will be performed in accordance with code requirements and construction industry best-practices. The Sponsor team has executed more than $1 billion of construction projects in over 17 states nationwide.

The Property is just over 100 miles from both Boston and New York City. It is roughly ten minutes from downtown Great Barrington and Egremont, less than ten minutes from Mt. Washington State and East Mountain State Forest and their extensive hiking trails. Bish Bash Falls and Catamount Ski Area are also close by. Harman Marsh Pond is onsite.

The managers have already purchased, renovated, owned and operated a shared estate property, known as the Playhouse. The Playhouse is a 7,000 square foot estate situated on 220 acres in Berkshire County. It has been ranked the #1 most booked and most reviewed rental on VRBO in Berkshire County, out of over 500 available properties. This property was acquired by the managers for $340,000, renovated and sold for $1.299 million in October 2020, just over three years after the renovations were completed. We've attached a case study of The Playhouse for your review.

This is the plan for the Freeman Berkshires as well. Once renovation is completed and the property is operational and stabilized, the Managers will begin the process of finding a buyer. However, there is no guarantee that the Property will sell as quickly. This is a unique property and a precise timeline for sale is unknown. For that reason, while we are projecting a sale within 5 years, we have also included a return calculation for 10 years. See “About the Return” for a comparison of potential return to investors if the Property is sold in five years versus 10.

The Company plans to offer investors a 15% discount to the nightly rate at The Freeman Berkshires property for up to seven nights per year; If the investor lives in Berkshire County, the Company plans to offer them a little more with a 20% discount to the nightly rate. This extra discount affirms our commitment to the local community and earning local business.

Daniel Dus is the managing Partner of Shared Estates Asset Fund, GP, the Sponsor and Manager of, Shared Estates Asset Fund 1, LLC, which in turn is the Manager of the Company.

Daniel is currently overseeing a large scale solar project investment strategy, with approximately $600 million of project value already committed and contracted, for a $32 billion multinational corporation. Daniel has contracted roughly $1 billion of construction projects in 17 states, holds an MBA, is a Stanford Certified Project Manager and a Villanova Certified Master Lean Blackbelt with a focus on project financial management. Daniel grew up in the Berkshires, where many of his family still reside. He is committed to the economic redevelopment of this beautiful region and creating opportunities for all residents to reinvest in their local real estate market.

The Sponsor’s team also includes Anna Battoe, David and Shannon Erwin, Orion Parrott and Jason Dus. All are general partners in Shared Estates Asset Fund, GP.

Anna Battoe is an attorney (J.D. - University of Florida, Fredric Levin College of Law) and trained accountant (B.A. - University of Iowa, Tippie College of Business). She's spent the past 8 years working in banking regulatory compliance, both directly for a large financial institution and prior to that, serving a range of financial institutions through a consulting firm. Previously, she interned in private accounting, with The United States Treasury (Bureau of the Public Debt, Office of Chief Counsel) and United States Securities and Exchange Commission (SEC).

David and Shannon Erwin are also General Partners. Dave is an accomplished software designer and programmer, currently a Lead Technologist at the New York Times. Shannon is a marketing and client relations specialist, including working at the School of Visual Arts in marketing, alumni and development roles. David and Shannon will assist in deployment of the Fund’s online presence and booking platforms.

Orion Parrott is a serial entrepreneur and Berkeley MBA. Having previously lived and worked in Massachusetts as a Raytheon systems engineer, he spent the last five years building businesses in tech and finance on the West Coast. He has successfully owned and operated rental property for over 20 years. Orion’s role on the team is primarily finance and operations.

Jason Dus is a General Partner and Massachusetts licensed General Contractor. Jason has overseen tens of millions of dollars of turnkey construction work in the target market, and will lead rehabilitation of Fund properties.

The Berkshires is a cultural tourist destination, noted as a center for the visual and performing arts. Renowned local art museums include the Norman Rockwell Museum, the Clark Art Institute, the Massachusetts Museum of Contemporary Art (Mass MoCA), and the Williams College Museum of Art. Performing-arts institutions in the Berkshires include Tanglewood Music Center and Boston University Tanglewood Institute in Lenox, the summer home of the Boston Symphony Orchestra; Shakespeare & Company in Lenox; summer theatre festivals such as the Berkshire Theatre Festival in Stockbridge; and America's first and longest-running dance festival, Jacob's Pillow. The area is also home to the Kripalu Center of Stockbridge, "North America's largest residential facility for yoga, holistic health and education.”

A variety of winter and outdoor activities attract year-round tourism, including three ski resorts (Bousquet, Butternut and Jiminy Peak) and the longest zipline in the U.S. As a result, the Berkshires are home to a large and growing tourist economy. Tourist spending in the Berkshires was recorded by the Massachusetts Office of Travel and Tourism as $420 million in 2017. Its unique cultural centers have resulted in the development of some of the leading U.S. resorts, spas and hotels, such as Blantyre, Canyon Ranch, Miraval (formerly Cranwell) and the Wheatleigh. None of these properties are available to lease as entire estate, or shared rental, and the cost of events at these venues reaches into the tens of thousands of dollars.

Historically, these estates were only available to the ultra-rich. But now, the Sponsor plans to market to the upper middle-class demographic including millennials. The Sponsor plans to select, redevelop, and offer new assets as luxury short term vacation rentals. By achieving low-cost acquisition and high-value upgrades, the Fund will offer renters far better value than traditional hotels and bed & breakfasts on a per-person basis. In short, the Fund brings the luxury estate experience to the middle class.

About group travel

Group travel includes weddings, birthdays, anniversaries, reunions, extended family vacations, corporate retreats and more. In business travel, the group travel segment is the largest and fastest growing at more than 4.5% compounding annually since 2017 and predicted to continue through 2023. A variety of attributes of group travel make it an attractive market focus for SEA Fund:

Reliable source of travel revenues. Groups continue to travel regardless of economic downshifts. Groups plan well in advance of their trip, usually 6-12 months ahead; reservations are secured ahead of time.

Groups travel year-round. Other tourists are tied to prime travel seasons, but groups have different motivations for travel and often seek low-season or mid-week trips to fit their needs.

Groups result in high exposure, future interest, and repeat business. As trends and lifestyles change, so do the types of groups that travel. Destinations benefit from new travelers that range from niche travel clubs fulfilling a mission to affinity groups such as women’s, performance and voluntourism groups. By the numbers, stays by these large parties result in properties obtaining more exposure over time than smaller venues; for example, the 7,000 square foot PLAYHOUSE (case study below) has hosted over 2,000 guests since it opened in 2016 – with many of these guests also becoming repeat guests. Some have already booked their fourth stay at the venue in as many years.

One decision maker delivers more travelers. Every “planner” represents a range of 20-40 potential travelers. These planners are the social networkers, organizers, coordinators, leaders or facilitators that a large family, group of friends or company has working to plan and schedule travel.

Underserved market. Historically, large groups have been limited to block-bookings of large hotels, motels or bed & breakfasts. There is a stark limitation of available inventory of stand-alone large format short term rentals. A national search of VRBO/HomeAway, filtered for properties with 19 or more bedrooms, produces only about 40 results, and fewer than a dozen are high end.

Sponsor properties deliver premium amenities and finishes at a distinct cost advantage to alternative group travel options such as hotels, motels and bed & breakfast properties. For example, a group of 25 travelers might save more than approximately $5,900 for a five-night stay:

| Cost comparison | Hotel | Shared Estate |

| Number of occupants | 25 | 25 |

| Number of rooms (2 people per room) | 13 | N/A |

| Average nightly rate | $210 | N/A |

| Group of 25 | $2370 | $1548 |

| Cost of 5-night stay | $13,650 | $7,740 |

- Luxury for everyone. Renovation of an historic luxury estate for middle class family gatherings.

- Sharing economy. Lower cost per person than standard hotel rooms.

- Sustainable. Carbon neutral, no single-use amenities, reclaimed building materials.

- Robust vacation market. Year-round tourist activities.

- Cultural epicenter. MASS MoCA, Tanglewood and Jacob's Pillow are among the many cultural neighbors.

- Local commitment. Sponsor plans to donate 1% of total rental income to The Elizabeth Freeman Center, a local service supporting victims of domestic abuse and assault.

The original section of the estate was built in the 1800s with an Adirondack Lodge layout, and a large red-brick addition was added later, increasing the property to over 11,000 square feet.

The rehabilitation used expensive, high-end, materials, including imported marbles, hardwoods and giant pine. However, the Property is in need of a thorough update as outlined in the following plan.

There are no major structural issues with the Property. All of the work planned is focused on decreasing operating expenses or improving the appeal of the Property for the target market of high-end luxury short term rentals. Corrective measures recommended in a home inspection report will be addressed in the planned construction activities to ensure the integrity of the building.

Two unfinished rooms in the basement are planned to be refinished to the same level of quality as the rest of the home, including the installation of hardwood floors. The main floor office will be converted to a bedroom as well with the goal of creating three additional bedrooms if permitted.

Heating and cooling, handlers and zone equipment are fully functional, in good shape, and will remain as-is. Equipment controls are all expected to be web-enabled. If any added capacity is needed for the new bedroom additions or otherwise, new mini-split units will be installed. A variety of insulation improvements may also be completed, including replacement of any single pane glass windows and doors if applicable. Some minor soffit or trim repairs may be required.

The garage space has a large, unfinished loft, approximately 1,000 square feet in size. We plan to convert and refinish this area into a game room, and add mini-splits for localized heating and cooling. The rear portion of the garage includes a large covered brick space which we plan to convert into an indoor-outdoor space.

Aesthetic improvements

Although the kitchen and all bathrooms are fully functional, aesthetic improvements are necessary. In order to improve the modern look and feel of bathrooms, we plan to replace all fixtures.

Planned kitchen improvements include all new high-end appliances. Woodwork will be sanded and refinished with clear-coats or Scandinavian whitewash where applicable.

Selective repainting of both the interiors, all white, including recaulking and restoration is anticipated. A light lime white-wash of the red exterior brick followed by sandblasting is planned to create a rustic, antique mansion aesthetic. We expect to install original art pieces to complete all rooms. Luxurious beds will be selected for each room, along with day beds in some of the gathering spaces.

Grounds, pool, IT and outdoor spaces

We are planning to rehabilitate all landscaping, and additionally to create a 3,000 square foot English-style, labeled organic English kitchen and flower garden which will be replanted annually, and produce from which will be included in welcome baskets. New landscaping plantings are expected to augment existing beds throughout, and additions made around the road frontage, garage, parking areas and entryways. Additional parking will be added if possible. Columns are planned to enhance the entrance and possibly gate-restricted access as well. The tennis court needs to be completely renovated and we are planning a large bluestone patio in the rear yard. In addition, a new luxury in-ground pool with lounge area is planned for along with attendant outdoor furniture.

We also plan to add a new pond board-walk and dock with a small boat-house in order to facilitate pond access and provide for a pond-side sitting and photos area.

The Company plans to build a trellis and plant two to three hundred grape vines to establish a micro-vineyard on a portion of the parcel for photo opportunities and grapes will be added to the welcome baskets in-season.

We plan to renovate the existing stone patios with metal work and also to expand them to accommodate a large outdoor grill area, outdoor dining tables and cocktail tables. A large decorative greenhouse will likely be built to provide additional indoor/outdoor spaces.

IT improvements are core to the renovation. Web-enabled flatscreens and high-end wireless-integrated smart-speakers are planned throughout, in all bedrooms and shared spaces. Web-enabled light bulbs are also planned in each bedroom. Security systems will include video at each main entry door. It’s likely that two or three internet hubs will be required with multiple repeaters / signal-boosters. Internet signal will be available across the main portion of the Property. Dedicated tablets with all associated software are planned to be available in all main rooms.

The General Partners include a licensed Massachusetts General Contractor, Jason Dus, and will self-perform most of the related work. Some specialty trades will be subcontracted to leading local vendors.

Review this project budget for further detail.

The acquisition price of the Property is $1,600,000. The Company expects to finance the purchase with $80,000 in cash, and $1,520,000 in seller financing. Seller financing has been obtained at 5% APR, amortizing on a 30-year schedule. Closing costs, including the initial $80,000 cash outlay, and all of the renovation work planned are expected to be fully financed through equity.

The total project cost, including anticipated renovations, acquisition, preparation for rental of the property and carrying costs during construction is expected to be $2,410,000 - $1,520,000 will be provided through the seller’s finance and the remainder, $890,000 through equity invested. While the Manager hopes to raise $890,000 through this Offering, $390,000 to be invested by Sponsor on the same terms as Investor Members, they have the required funds in equity in hand to fully capitalize the Project.

The managers have already purchased, renovated, owned and operated a shared estate property, known as the Playhouse. The Playhouse is a 7,000 square foot estate situated on 220 acres in Berkshire County. It has been ranked the #1, most booked and most reviewed rental on VRBO in Berkshire County, out of 55, available properties. This property was acquired by the managers for $340,000, renovated and sold for $1.299 million in October 2020, three years after the renovations were completed.

This is the plan for the Freeman Berkshires as well. Once renovation is completed and the property is operational and stabilized, the Managers will begin the process of finding a buyer. However, there is no guarantee that the Property will sell as quickly. This is a unique property and a precise timeline for sale is unknown. For that reason, while we are projecting a sale within 5 years, we have also included a return calculation for 10 years. See “About the Return” for a comparison of potential return to investors if the Property is sold in five years versus 10.

Annual operating expenses for the Property are expected to be around $167,600, with anticipated income of $378,545. Income fluctuations may vary as follows:

| Rental scenarios | Low | Expected | High |

| Number of reservations | 50 | 59 | 65 |

| Night booked | 208 | 222 | 242 |

| Occupancy rate | 57% | 61% | 66% |

| Average nightly rate (2021) | $1,238 | $1,548 | $1,857 |

| Anticipated 2020 revenues | $270,004 | $378,545 | $531,894 |

A detailed project budget can be downloaded here.

The Freeman is 71% larger than the Playhouse, with two more bedrooms and the ability to house 5 more people.

| The Playhouse | The Freeman | |

| Sqaure footage | 7,000 | 11,400 |

| Number of bedrooms | 6 | 8 |

| Number of bathrooms | 5 | 5.5 |

| Dedicated acres | 0.2 | 40 |

| Maximum occupancy | 20 | 25 |

We’ve based rental projections on these differences as follows, and are using the medium projections to model our anticipated Net Operating Income.

| Playhouse (Actual) | Freeman (Low) | Freeman (Med) | Freeman (High) | |

| Average nightly rate | $1,095 | $1,238 | $1,548 | $1,857 |

| Number of nights | 242 | 208 | 222 | 242 |

| Occupancy rate | 66% | 57% | 61% | 66% |

| No. of premium one-night rentals | 5 | 10 | 15 | |

| Premium one-night rental fee | $2,500 | $3,500 | $5,500 |

There are no ancillary revenues assumed in these projections, only property-based rental incomes. The Managers may pursue additional revenues through offering premium services such as concierge services, arranged events from third party vendors and other experienced-based add-ons to the property rental rates.

Further detail on the operating budget and anticipated rentals can be downloaded here.

The Company is engaged in three simultaneous offerings of its securities:

- An offering under §4(a)(6) of the Securities Act of 1933, which we refer to as the “Reg CF Offering”;

- An offering under 17 CFR §230.506(c), which we refer to as the “Reg D Offering”; and

- An offering under Regulation S (where only non-US persons can invest), which we refer to as the “Reg S Offering.”

The Reg S Offering is directed only to persons who do not live in the United States and are not U.S. citizens or residents.

We plan to use the proceeds of the three offerings, $890,000, together with seller financing, to purchase and renovate the property known as Freeman Berkshires, at 46 Bow Wow Rd, Egremont, MA, 01230.

In an offering under Regulation CF the issuer is required to state a “Target Amount,” meaning the minimum amount the issuer will raise in the Reg CF Offering to complete the offering. For the reason just described, our Target Amount for the Reg CF Offering is $1,000.

It doesn’t matter how much is raised in the Reg CF Offering and how much is raised in the Reg D and Reg S Offerings. Thus, if we raise $1,000 in the Reg CF Offering and at least $99,000 in the Reg D and/or S Offerings we will proceed, and vice versa.

However, we will not complete the Reg CF, Reg D or the Reg S Offerings unless we have raised a total of at least $100,000 (minimum goal) by January 31, 2021. If we haven’t, all three offerings and all investment commitments will be cancelled, and all committed funds will be returned.

The minimum investment in the Reg CF Offering is $1.000, and the minimum investment in the Reg D Offering is $10,000. Investments above the minimum amount may be made in $500 increments (e.g., $1,500, $2,000 or $2,500, but not $2,136). Investors can cancel their commitment up until 11:59 pm EST on January 29, 2021.

After that, any funds raised will be released to the Company and Investors will become Investor Members of the Company. The Company may decide to change the offering Deadline but will provide at least five days’ notice of such a change to all Investors. Investors will also be notified and asked to reconfirm their commitment if any other material changes are made to this offering.

The SEC is considering other changes to Reg CF, in addition to raising the maximum offering amount. Where applicable, we will reference possible changes in the applicable sections of the Form C.

The full disclosure documents, which include Form C can also be downloaded and viewed on the Securities and Exchange Commission’s website.

Under the LLC Agreement, all distributions will be made annually in the following order of priority, after bank or seller financing loans have been repaid:

- First, the Available Cash shall be distributed to the Investor Members, including the Sponsor as Investor Member, until they have received their Preferred Return of 8% for the current year.

- Second, the balance of the Available Cash, if any, shall be distributed to the Investor Members, including the Sponsor as Investor Member, until they have received any shortfall in the Preferred Return for any prior year.

- Third, the balance of the Available Cash, if any, shall be distributed to the Investor Members, including the Sponsor as Investor Member, until they have received a full return of their Unreturned Investment.

- Fourth, the balance of the Available Cash, if any, shall be distributed as follows until Investor Members, including the Sponsor as Investor Member, have received an amount equal to twice (200% of) their original investment in total.

- 80% to the Investor Members, including the Sponsor as Investor Member; and

- 20% to Sponsor as a promoted interest.

- Fifth, the balance of the Available Cash, if any, shall be distributed:

- 60% to the Investor Members, including the Sponsor as Investor Member; and

- 40% to Sponsor as a promoted interest.

As a bonus, the Company plans to offer each Investor Member a 15% discount to the nightly rate at The Freeman Berkshires property for up to seven nights per year; If the investor lives in Berkshire County, the Company plans to offer them a little more with a 20% discount to the nightly rate. This extra discount affirms the Company’s commitment to the local community and earning local business.

You can review the operating pro formas for further detail.

A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, Investors must rely on their own examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. Furthermore, these authorities have not passed upon the accuracy or adequacy of this document.

The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

There are numerous risks to consider when making an investment such as this one and financial projections are just that - projections. Returns are not guaranteed. Conditions that may affect your investment include unforeseen construction costs, changes in market conditions, and potential disasters that are not covered by insurance. You should review these additional Risks of Investing for a more expansive list of potential risks associated with an investment in this Company.

Unless otherwise noted, the images on the offering page are used to convey the personality of the neighborhood in which the project is planned. Properties shown in these images are not included in the offering and Investors will not receive an interest in any of them.

COVID-19 Disclosure

COVID-19 has so far had a significant negative impact on the economy overall with regards to increased unemployment, reduced consumer and travel spending, and challenges to hospitality businesses such as hotels and restaurants. However, recommendations by the National Institute of Health (NIH) and new consumer behaviors including escaping urban environments, social distancing and creating COVID bubbles have increased rural demand both for ownership and retreat opportunities. The rural redevelopment plan of the Company has not changed in response to COVID-19 but in fact has been reaffirmed by long term expected changes in market demand. Because of the unprecedented nature of this 100-year event, the Company discloses here both positive and negative potentialities that may result.

Negative effects

- Local regulations may restrict or prohibit travel to or from other areas.

- Restaurants and local amenities may be less available to potential renters encouraging them to stay at their permanent residence. Cultural performances and museums may become unavailable.

- People may be less willing to travel by air to remote destinations.

- People may be concerned about rental accommodations being fully sanitized before their stay.

- These conditions are subject to change and we don’t know how long these negative effects may continue.

Positive effects

- Demand for rural real estate rentals has increased and may continue to do so. AirBnB reports a 25% increase in bookings for rural destinations over 2019. This trend resulted in stronger bookings of The Playhouse and may result in higher nightly rates and more nights booked.

- Demand for rural real estate has also increased and may lead to a higher exit sale price for the Property. Sales are up 14% and pending listings are up 53% compared to last year. The website theBerkshireedge.com has called it a “buying frenzy” in the Berkshires.

- As people seek to isolate themselves from urban environments, demand for all types of rural accommodations has increased.

- Many more people are working from home and may need more space than available in their current primary residence. As people spend more time at home, demand for larger properties has increased and may continue to do so. Demand for amenities outside the property may decrease.

- These conditions are subject to change and we don’t know how long these positive effects may continue.