Westvue Manhattan

Ground zero for the robotic construction revolution.

-

Location. Location. Location. Adjacent to the Hudson Yards Neighborhood of Manhattan

-

Affordable. Condos planned to sell at a lower than market price to help with the affordability crisis in NYC

-

Views. At 24 stories tall, the building affords permanent views for residents to the west, south and north

-

Lower than Market. Land acquisition at an attractive price and a lower basis than the market

-

Cutting edge tech. For construction optimization and acceleration, using BIM modeling / Digital Twins, AI, and Robotics

-

Robot-built. Perhaps the most robot-built project in the world, with extensive robotic automation planned for the construction

-

Condo approval pending. Plans have been filed with NY State Attorney General

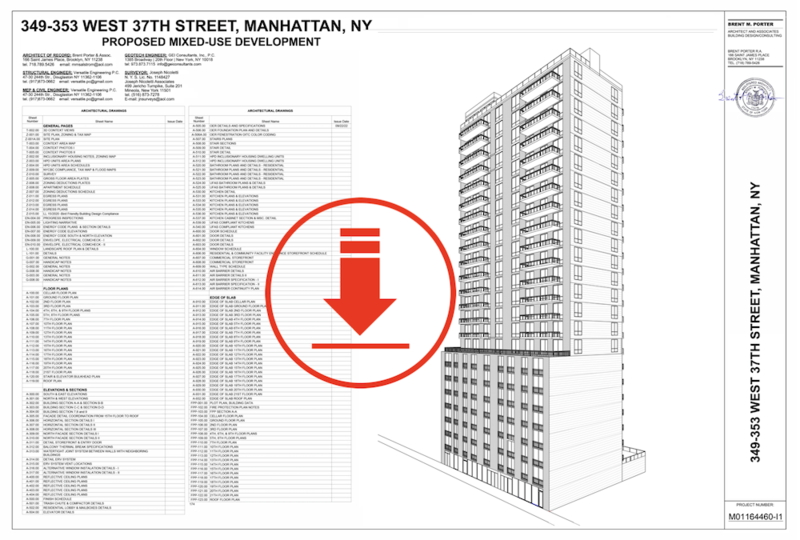

The Westvue NY is a planned 24-story residential tower in Hudson Yards East, Manhattan, featuring 115 residential and one retail condominium unit (the “Project”). It’s an unusual project on two counts. First, target sale prices are 15 - 25% lower than similar market rate projects in the immediate area. Second, we plan to have ten or more institutional venture-capital backed robotics companies working on the project, and we believe it will be the most robot-built high rise building in the world to date.

Construction plans have been pre-filed with the New York City (“NYC”) Department of Buildings, and completion is currently estimated for mid-to-late 2027, subject to permitting, financing, and unexpected construction issues. All robot use will comply with existing building codes and all current construction regulations.

The project site is located between 8th Avenue and 9th Avenue at 349-353 West 37th Street (the “Property”) and consists of two combined lots (349 & 353 West 37th Street), each 50 by 98.75 feet, for a total of approximately 9,875 square feet. Plans call for the demolition of the existing six-story commercial loft building (26,260 square feet) and the construction of a new 135,000 gross square-foot residential building with terraces and storage units.

The development site was previously used as a wholesale beverage distribution facility and includes a six-story commercial loft building containing 26,260 square feet. Permits and approvals required for demolition and construction are underway but remain subject to regulatory timing and potential delays.

The existing six-story commercial loft building is expected to be demolished once the required permits are obtained. Regulatory approvals, including those from the NYC Department of Buildings, are necessary before construction can begin and are outside the sponsor's control.

This project proposes to add 115 residential units to Manhattan's Hudson Yards area. The targeted average unit pricing of approximately $1,750 per square foot is 15 - 30% below the average market price for similar condominiums in the neighborhood, based on current market analysis. Average condo sales in the neighborhood are currently in the $2,100–$2,500 per square foot range. Actual pricing is expected to depend on market conditions at the time of sale, unit attributes, and buyer demand, and there is no assurance that pricing will match projections. Note that while new housing stock may contribute to local supply, individual developments have a limited impact on broader affordability dynamics.

Hudson Yards historically has experienced vacancy rates below 2%, indicating tight housing conditions. Adding new inventory may help meet local demand, though market pricing and conditions ultimately determine the impact on supply equilibrium.

The construction timeline is estimated at 24 to 36 months from the commencement of construction, subject to permitting, financing availability, and construction conditions. The project’s estimated timeline to construction start is as follows:

April 2026 - Condominium approval

May 2026 - Condo Pre-Sales begin

May 2026 - Building permit approved

July 2026 - Completion of pre-construction

August 20206 - Demolition begins

September 2026 - Construction starts

The neighborhood has transitioned from industrial use to a mixed-use district over the past two decades. However, historical redevelopment trends do not guarantee future neighborhood performance, stability, or increases in property value.

Environmental conditions tied to the "e" designation are standard for specific Manhattan locations and have been incorporated into design specifications. These environmental restrictions impact building design (e.g., sealed windows, no gas service) and may influence operating costs and unit features.

Shahn Christian Andersen, the developer, has formed VDX 351 W37 OWNER LLC (the” Company”) to acquire and construct the Project. He has partnered with Albert Nigri, Summit Assets, to co-build the project and to act as loan guarantor. Regulatory approvals, including those required to begin selling condominium units, are outside the sponsor's control and may take longer than anticipated.

Shahn Christian Andersen, the manager of the VDX 351 W37 OWNER LLC (the “Company”), brings three decades of specialized expertise in construction, architectural design, and BIM modeling to the forefront of the industry. An alumnus of the School of Visual Arts in Manhattan, Shahn began his career in human-user interface and industrial design. He eventually transitioned to architecture through an internship at Brent Porter & Associates, the private practice of Pratt Institute professor Brent Porter. This unique background allows Shahn the rare ability to translate complex digital models into real-world, buildable outcomes.

Shahn Christian Andersen, the manager of the VDX 351 W37 OWNER LLC (the “Company”), brings three decades of specialized expertise in construction, architectural design, and BIM modeling to the forefront of the industry. An alumnus of the School of Visual Arts in Manhattan, Shahn began his career in human-user interface and industrial design. He eventually transitioned to architecture through an internship at Brent Porter & Associates, the private practice of Pratt Institute professor Brent Porter. This unique background allows Shahn the rare ability to translate complex digital models into real-world, buildable outcomes.

A seasoned entrepreneur, Shahn has successfully founded two venture-backed technology companies and has overseen the design, management, and construction of more than $500 million in real estate projects throughout his career.

Some examples of recent projects are: 285 Schermerhorn Street-development project in downtown Brooklyn, 475 Washington Avenue - a 70,000 square foot 60 unit landmarked multifamily building in the Clinton Hill neighborhood of Brooklyn and 388 Broadway - a 35,000 square foot 8 unit IMD loft law building with ground floor commercial.

His work is driven by the belief that the solution to the national housing crisis is found in technology-driven, private-sector delivery. Shahn is dedicated to moving beyond traditional "affordable housing" models to pioneer the development of "housing people can afford," bridging the gap between innovative technology and practical project execution.

Albert Nigri and his Company, Summit Assets, joins Shahn on the Westvue team as co-builder. Albert has over 30 years of experience designing and developing commercial, retail, and residential projects across the NYC region and nationally. His portfolio includes ground-up construction, adaptive reuse projects, and mixed-use developments ranging from retail centers to high-rise residential buildings.

Notable projects include multiple developments in Newark, New Jersey, and an extensive commercial portfolio spanning several states. Nigri's experience encompasses project types from shopping centers and office buildings to luxury residential estates, with a focus on repositioning underutilized properties and managing complex construction projects.

Jared Antin serves as Managing Director at Brown Harris Stevens and is the senior sales manager for the Westvue project. He and his team provide access to local and international marketing networks and referral partnerships.

Summit Equities has been engaged for construction management, and Citizens Private is providing preferred buyer financing resources to qualified buyers.

Hudson Yards has historically experienced low residential vacancy and higher median incomes than the national average. Recent condominium sales in the area ranged between approximately $2,100 and $2,500 per square foot, though past data do not predict future pricing outcomes.

Market data from 2023–2024 (based on publicly available sources, including StreetEasy, Miller Samuel Inc and NYC property records) shows:

- Residential vacancy rate near 1.98% in 2023

- Median household income ~ $127,814

- Average condo sales in the $2,100–$2,500 per square foot range.

Westvue’s targeted pricing of ~$1,750 per square foot is a forward‑looking estimate and may change materially based on conditions in the 2026–2027 sales period.

Market risk factors include:

- Real estate markets are cyclical and can experience material downturns.

- Interest rate increases can reduce purchasing power.

- Competing inventory may impact pricing and absorption rates.

- Historical data does not reflect future demand or pricing

The Company is engaged in a Regulation Crowdfunding (Reg CF) offering (the “Offering”) to raise money for a 135,500 gross s.f., ground up residential building, located in New York City, at 349 & 353 West 37th Street, Hudson Yards.

We are trying to raise a maximum of $3,500,000, but we will move forward with the Project and use investor funds if we are able to raise at least $1,500,000 (the “Target Amount”). If we have not raised at least the Target Amount by 11:59 PM EST on August 30, 2026 (the “Target Date”), we will terminate the Offering and return 100% of their money to anyone who has subscribed.

The minimum you can invest in the Offering is $1,000. Investments above $1,000 may be made in $500 increments (e.g., $1,500 or $2,000, but not $1,136). An investor may cancel his or her commitment up until 11:59 PM EST on August 28, 2026 (i.e., two days before the Target Date). If we have raised at least the Target Amount, we might decide to accept the funds and admit investors to the Company before the Target Date; in that case we will notify you and give you the right to cancel.

After we accept the funds and admit investors to the Company, whether on the Target Date or before, we will continue the Offering until we have raised the maximum amount.

Investments under Reg CF are offered by NSSC Funding Portal, LLC, a licensed funding portal. This offering is registered with the SEC.

We have created a mathematical calculation based on our current assumptions about the Project's completion and operations. We estimate that sales of condominiums will gross $210 - $220 million, with project expenses totaling approximately $140 - $150 million before broker’s commissions, closing costs and other closing expenses.

Class C investors in this Offering will receive a fixed return of 17% interest, compounding for each year that their investment remains unreturned. The project is expected to take 30 to 36 months to complete construction and full sale of all condominiums.

The table below provides a summary of anticipated sources, uses and free cash available for both the return offered and the return of equity.

| Year 1 | Year 2 | Year 2 | |

| Sources | |||

| Investor Capital | 3,500,000 | ||

| Bank Loan | 20,000,000 | 80,000,000 | |

| Sales Proceeds | 215,000,000 | ||

| Total Projected Inflows | 215,000,000 | ||

| Uses | |||

| Payoff of Debt | 80,000,000 | ||

| Pre-Construction Costs | 1,500,000 | ||

| Construction Costs | 78,500,000 | ||

| Marketing Costs | 1,500,000 | ||

| Closing Costs | 7,000,000 | ||

| Total Projected Outflows | 88,500,000 | ||

| To Class C Investors | |||

| Return of Equity | 3,500,000 | ||

| 17% fixed return with compounded interest | 2,105,000 | ||

| Total to Class C Investors | 5,605,000 |

Some of our assumptions will prove to be inaccurate, possibly for the reasons described in the Risks of Investing document. Therefore, the results of investing illustrated in our calculation are likely to differ in reality, for better or for worse, possibly by a large amount.

Please also review the LLC Agreement and Crowdfunding Vehicle LLC Agreement for additional detail on how distributions are planned to be made.

Total acquisition and development costs of approximately $132.62 million are planned to be financed by a senior lender, providing a $82.35 million loan, $23.27 million in mezzanine financing by PACE, $10 million in sponsor equity with an additional $17 million in investor equity, some of which will be raised through this Offering. Construction is expected to be completed within 24 - 36 months of construction start. The Company expects to sell the Condominiums within 18 months after construction is completed.

Investor distributions will be made, per the LLC agreement, after all debts have been paid. The financing assumptions to purchase and develop the project are as follows:

| Sources | |

| Senior Lender | $82,350,000 |

| PACE / Mezzanine Financing | $23,270,050 |

| Sponsor Equity | $10,000,000 |

| Imputed Equity Contribution | $17,000,000 |

| Total Sources | $132,620,050 |

| Uses | |

| Land Purchase | $24,000,000 |

| Imputed Equity at Loan Closing | $17,000,000 |

| Hard Cost Budget | $65,500,000 |

| Soft Cost Budget | $3,654,000 |

Sales are expected to gross approximately $221 million. Once closing costs of an expected $14.365 are deducted, it is anticipated that the project will net around $74 million.These figures assume:

- Successful sale of all 115 residential and 1 retail unit

- Average pricing near $1,750 per square foot

- Cost control within current budgets

- Sales are favorable to projections

Financial figures provided are forward‑looking estimates based on current assumptions. They have not been audited or independently verified and may differ materially from actual outcomes.

For further detail, please review the section below called How will this work for you?, the risks disclosure document and a more detailed soft cost budget.

The project's cost management strategy and development philosophy centers on planning efficiency rather than government subsidies or affordable housing programs thereby creating housing people can afford through construction efficiency and supply addition, rather than government-subsidized affordable housing programs. Whether digital planning translates into cost savings or greater accessibility depends on execution and market conditions during construction and sales.

The development approach incorporates digital planning tools such as Building Information Modeling (BIM) to support design coordination. While these technologies support planning, they do not guarantee cost reductions, faster schedules, or avoidance of construction issues.

The project team plans to use BIM throughout the design and documentation phases to help coordinate building systems before physical construction begins. Additional tools under consideration include AI-supported planning and certain robotics applications, though these are limited in current high-rise practice and do not ensure measurable efficiencies.

A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their own examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. Furthermore, these authorities have not passed upon the accuracy or adequacy of this document. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

There are numerous risks to consider when making an investment such as this one and financial projections are just that - projections. Returns are not guaranteed. Conditions that may affect your investment include unforeseen construction costs, changes in market conditions, and potential disasters that are not covered by insurance. Please review our Risks of Investing more expansive list of potential risks associated with an investment in this Company.

Unless otherwise noted, the images on this page are used to convey the personality of the neighborhood in which the project is planned. Properties shown in these images are not included in the offering and Investors will not receive an interest in any of them.